Enhanced Macroeconomic Simulation

The state of the economy has an impact on consumer demand.

When the economy is booming, there will be strong demand for consumer goods. Conversely, during a recession, consumers reduce their spending, especially for non-essential goods.

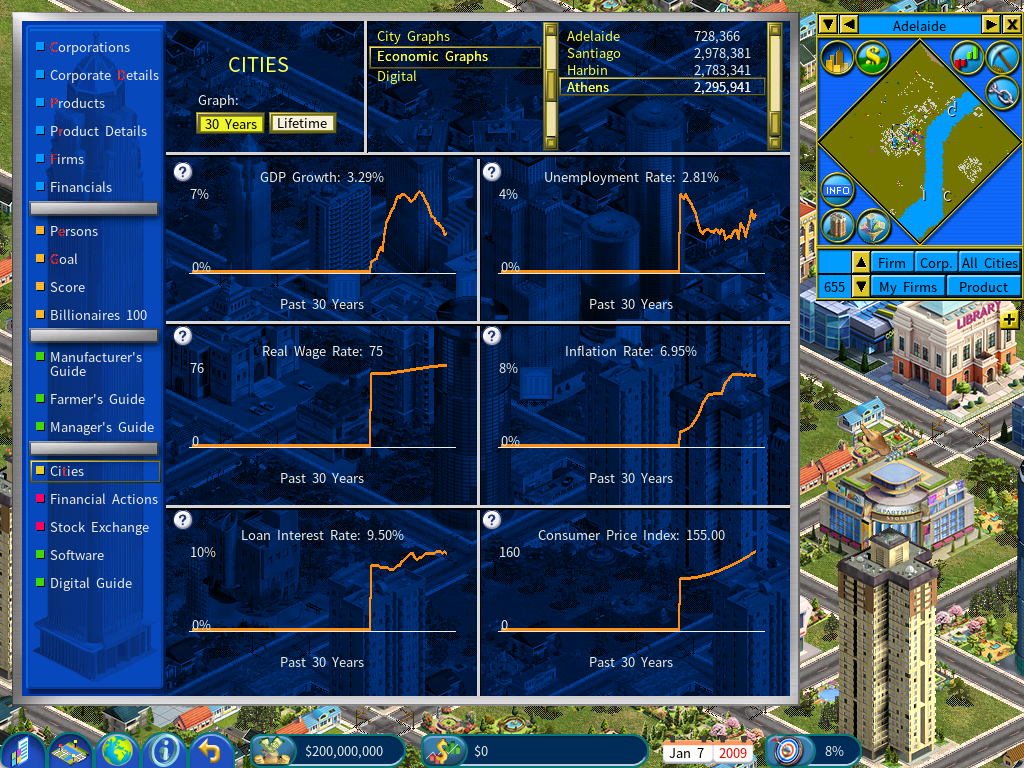

You may see the fluctuations of product sales shown on the graphs on the Product Summary Report, and compare them against the Economy report, to understand their correlations.

This adds new depth to the gameplay and the player may face situations where an economic downturn will turn a profitable business into money-losing one. Players will have to be more cautious of their cash buffer and their financial abilities to weather the storm during the bad times, which may come unexpectedly.

As incomes of people in developing cities improve, their demand for luxury goods will increase.

For example, a developing city like Shanghai in 1990 sees its real wage rate increase rapidly in the following decades. As people in the city enjoy higher salary incomes, they will be able to afford luxury goods like cars, video camera, leather bags and etc.

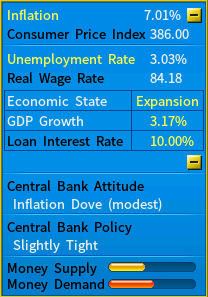

The Economy Report

The Central Bank and The Boom-and-bust Cycle

Bubbles in the stock market and property market may develop if the central bank maintains a loose monetary policy with ample money supply and a low interest rate.

In addition, stock prices rise and fall in tandem with different market sentiments and macroeconomic situations, in addition to financial performances of the underlying companies.

High GDP growth and a low unemployment rate will reinforce optimism and investors’ risk appetite will increase, leading to price rallies in the stock and property market, which will in turn fuel inflation.

When the inflation spikes to a dangerous level, the government will have no choice but to suppress it by hiking the interest rate and decreasing the money supply. Subsequently, the asset price bubbles may go bust and put an end to the current boom-and-bust cycle.

The boom-and-bust cycle will start all over again years later, after the inflation has been subdued and maintained at a low level for an extended period of time, allowing economic activities to pick up momentum again.