Office Space – Building a Real Estate Emporium

A Capitalism Lab strategy article written by user “colonel_truman”

(City Economic Simulation DLC is enabled and its new features are demonstrated in the gameplay described in this article.)

It´s 1996 and Tomahawk corporation has been pursuing a path of extreme indebtedness since its humble beginnings, teaming with the national bank of Sylvania to construct office districts in the cities of this brave new frontier country, expecting that the pay-off will be good enough to buy back its independence, sometime in the future.

For the moment the situation looks rosy… but is it so? Will the new residential districts turn into a profitable business? Is the current debt manageable under present circumstances? Could we ask for further loans to finance new projects without endangering the stability of the corporation? Will the bankers show their true colours and start sharpening their knives… once they realize we have grown fat enough?

In this new article, you will follow the CEO of Tomahawk corporation from the begining as he tries to succeed carving out a business in the Real State sector, in the tiny country of Sylvania.

We´ll explore certain aspects that often remain more dormant in traditional game plays. So if you feel your curiosity piqued, come and join the living thread, as we expect you´ll find useful insights that will help you understand better some of the mechanics of the game, and maybe spark anew your love for it.

We begin the gameplay in 1990, and will be using both the Subsidiary DLC as well as the City Economic Simulation DLC.

My main objective by writing this article will be (hopefully):

- to provide an enjoyable discussion of Tomahawk´s progress, our Real Estate (RE) corporation, through time.

- to show how playing a RE game can be both fun and challenging, and

- to provide useful insights, for your next game.

At the beginning we´ll be focusing primarily on our corporation´s perceived value: our assets, and their growth. That is, the value of our property, and it´s appreciation.

As we have a very small amount of money when we start, we need to find an investor willing to provide the cash we lack to fund our expansion.

So, we´ll choose Sylvania´s commercial bank as our main financing agent, and try to avoid stock market investors.

Most games focus on selling merchandise by producing and retailing it. In our case we will be selling something different, but selling nevertheless, these being claims on our property.

We´ll report every year money rates as they price such claims.

The bank will keep looking at the value of our property and will estimate how much to lend to us using mainly that criteria, so the more value we add, the bigger the credit line at our disposal.

We´ll start inflating our “30 million cash” assets by creating new RE districts in Sylvania´s cities. We´ll have to choose carefully the location of our first RE stronghold, and keep adding to it, maximizing the increase in value in our land purchases.

And to do so we´ll build on that land our own offices, and later on, apartments.

We´ll also try to enrich the gameplay providing a few off-game sheets that are fed by the game´s data, periodically:

- One to measure how profitable some of our residential buildings are: We´ll try to know the years it took them to pay back their credit funded set-up costs with their rent.

- One to show in one place the income and value we get: per building; per class of RE firm; per city; per square of land (as we consider our offices and apartments income-bearing land assets).

- One to try to size our liabilities (our debt) so they can be properly assessed and managed.

- One where we´ll compare our residential districts to our commercial districts, in terms of income and value, per city and globally.

- One where we´ll try to assess the viability of whole city sectors, considering our total liabilities and money rates.

Finally, if possible, we´ll attempt a modest nation building approach: by setting up new subsidiaries to engage in regular business, as well as by bidding for political power in every city.

Always trying to properly manage our debt, which we´ll have no particular reason to fully “return”…

The cities are Funk, Lynden, Glen Fork and Lambs grove.

There are 2 ports in each of them.

There are 4 real state companies that have bought land to develop a neighborhood of their own. (Guess a bit irrelevant, but for the record)

The city detail screen shows a strong demand in all of them for commercial buildings (about -50 to -60)

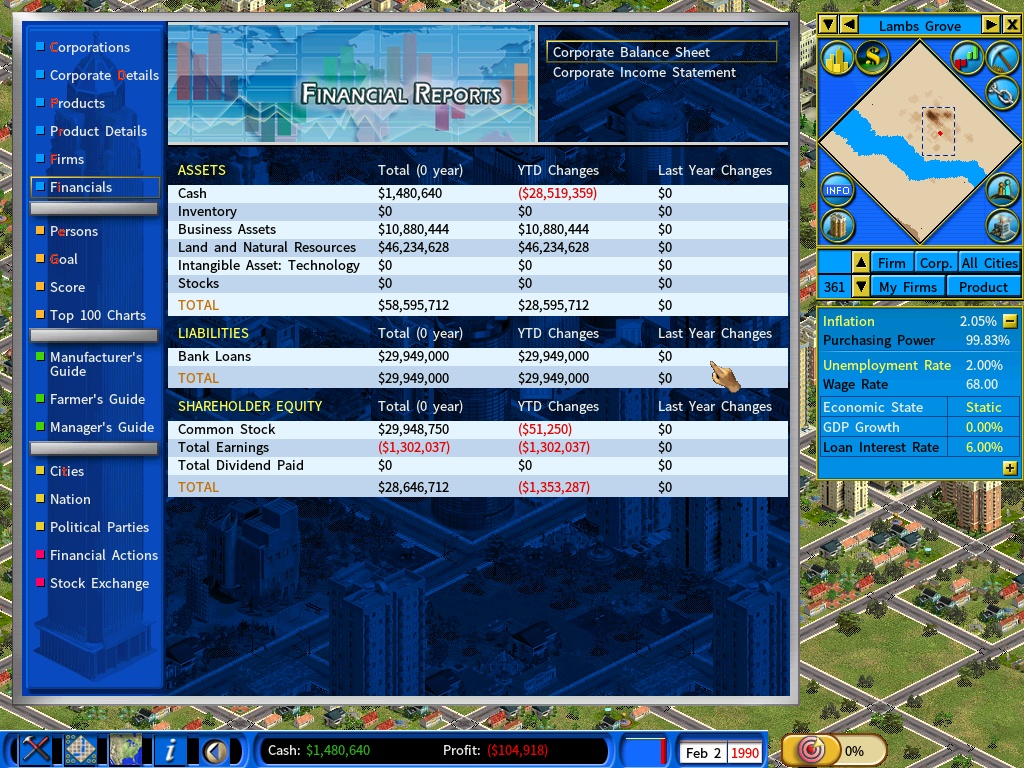

We have 2% inflation, and 6% interest on loans, so a 4% real interest rate.

I have chosen Lambs Grove as a starting point. Lynden has already 2 supermarkets spoiling the area.

These two have the highest wages, so the rent collected from the buildings will be higher. Also the land value is higher so it will pay the most to increase it there, in relative terms.

One might argue I could start in the cheapest city, but I prefer to have it tough at the beginning and easier later on.

Humble start.

I borrowed 30 million and bought a nice square, with a building in the middle to increase the value of the land around it.

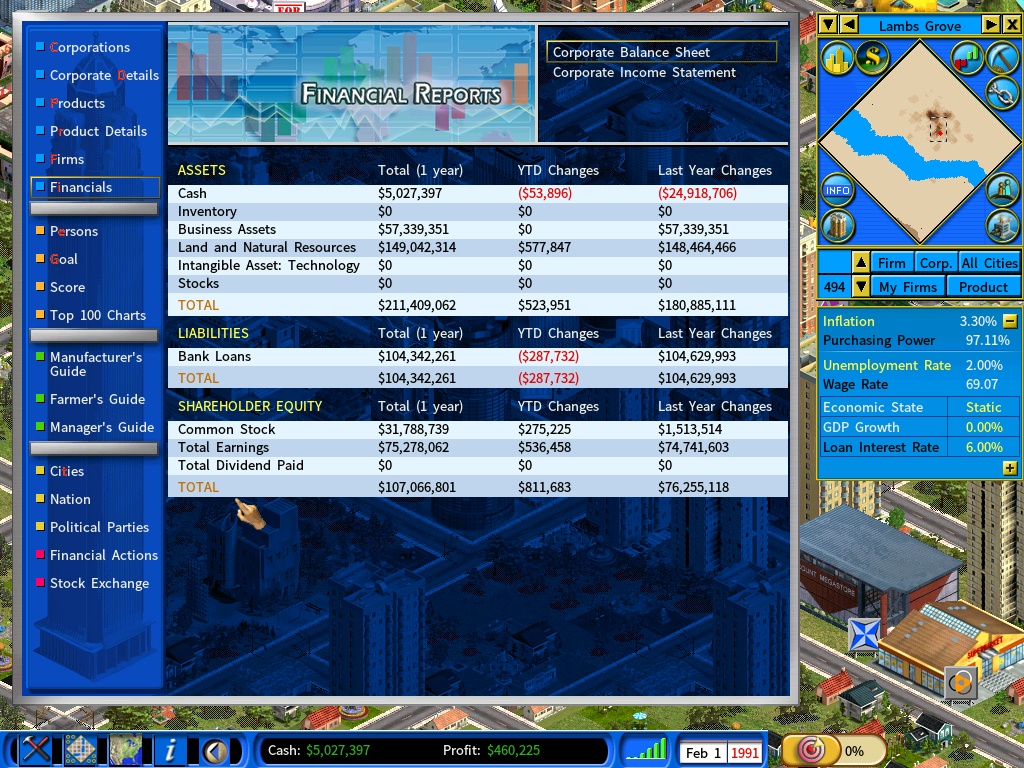

Here is the commercial district of Lambs Grove after one year of buying land and “placing” the skyscrapers. Notice how tight they are located in order to maximize the lift in land value, as each of them “support” the land below the others.

Very nice improvement to have the BIG office building as a 3×3 now. I called it the “value bomb” in previous games when it was a 4×4.

It doesn´t compete with the 2×2 in terms of rent income, but it increases the value around it the most. Correct me if wrong.

We owe the bank about 100 million. The increase in the company´s value has been about 77 million net (I discount the 30 million of starting capital), so the bank will allow its lending department to increase their line to us every passing month, or so. We´re paying 2.7% in real rates thanks to inflation (I changed it to inverse) So we are having cheap financing.

Here is the stock performance. It has doubled its price and is currently undervalued at 0.61 PB. We are not planning to issue new shares as we have cheap money from the bank, and most important, because we believe the company will become very profitable, very soon. So no need to offer cheap stock to new investors.

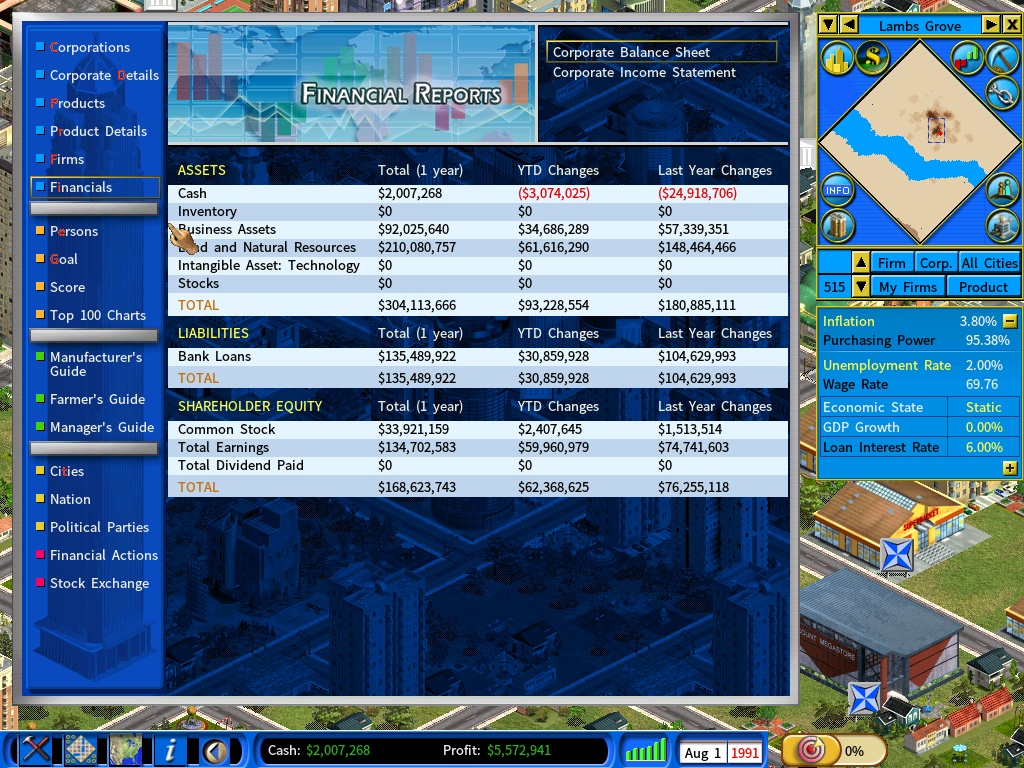

After one and a half years: We have completed building the financial district in Lambs Grove. We sell the land lying south so we have a bit more of capital to expand, and we´ll be selling the land north as soon as it increases in value.

The demand for office space in the city now stands at zero, so we have to move on to greener pastures.

The company now has a value of 168 million, so the building of the district was worth roughly 138 million, to date.

The real interest rate is 2.2% now thanks to an increase in inflation, so we have cheap financing still.

The price of the stock now stands at roughly 37$ per share, and climbing, and we have the best p/e of any company in the realm, what means we are already making a buck!

Still undervalued at 0.67 P/B. So no need to issue shares at all.