Understanding Bank Capital Requirements

Bank Balance Sheet

Unlike other types of firms in the game whose assets and liabilities are consolidated into the corporate balance sheet, a bank maintains its own balance sheet for the purpose of providing the player with a clear perspective on the bank’s operations, and to prevent distorting the parent corporation’s balance sheet with the bank’s typically huge amounts of assets and liabilities derived from customer deposits and loans.

Note that Deposits by Customers are listed as liabilities to reflect the fact that deposits are made by a bank’s customers. The bank owes the deposits to its customers and is obliged to pay out interest.

Loans to Customers are listed as assets and the bank expects to receive interest and principal repayments from the borrowers.

Net Assets, also called shareholders’ equity, are defined as a bank’s total assets minus its total liabilities. You need to keep an eye on the net assets as the central bank requires banks to have set aside enough capital to cover unexpected losses and keep themselves solvent in a crisis, which is called Bank Capital Requirement.

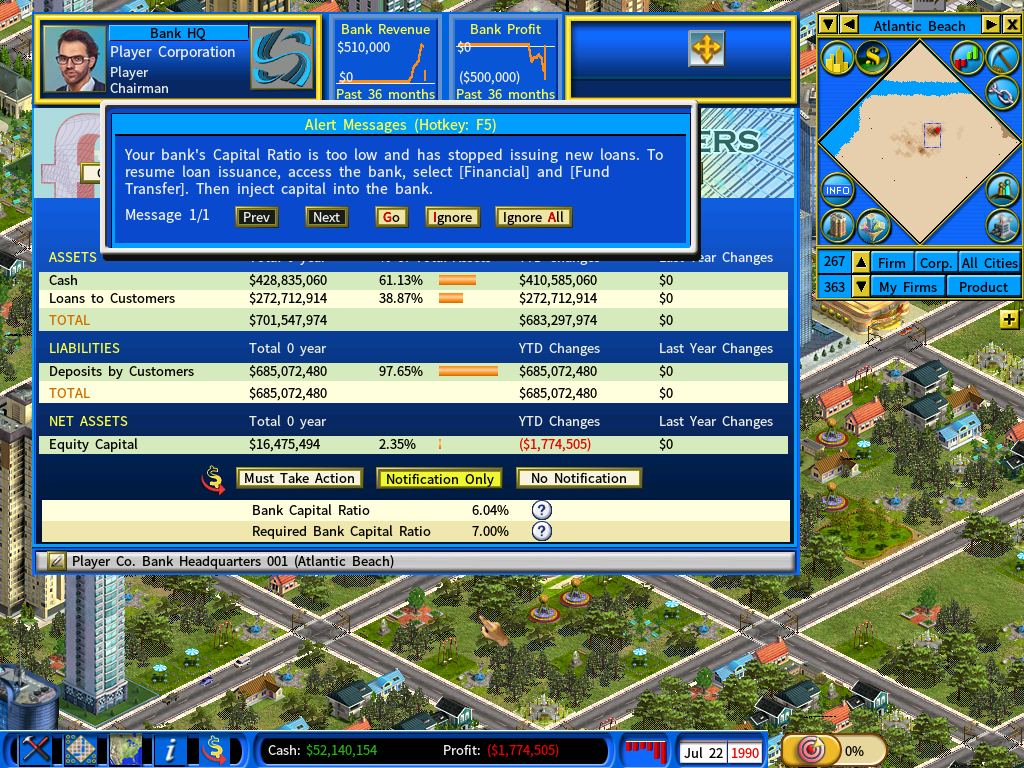

You will see the Bank Capital Ratio and the Required Bank Capital Ratio at the bottom of a bank’s balance sheet. The capital ratio is the ratio of a bank’s equity capital (also called Net Assets) to its total loans to customers. A bank must maintain a capital ratio that meets the central bank’s requirement.

When your bank’s Capital Ratio falls below the Required Bank Capital Ratio, an alert window will pop up requiring you to take action to inject capital to your bank.

The window shows your bank’s current capital ratio and the required capital ratio and the amount of shortfall. At this point, click on the [Transfer Fund] button to access the Transfer Fund interface, as shown below.

Now set a transfer amount and press the [Transfer to Bank] to execute the transfer and bring your bank’s capital to the required level. Once the compliance is met, you can close this window by right-clicking anyway on the screen and continue the game.

Options for Handling Insufficient Bank Capital Ratio

If you find the alert window prompting you to increase the bank capital ratio popping up too frequently and you prefer a more passive way of receiving the notification, you may change the notification mode as described below.

On the bank’s Balance Sheet page, you will see the following options:

1) Must Take Action

If this mode is selected, the game will pop up a window when the Bank Capital Ratio is insufficient. It is set to this mode by default.

2) Notification Only

If this mode is selected, the game will stop issuing loans and notify you via the Event Tracker.

In other words, when the Bank Capital Ratio falls below the requirement, it will no longer pop up the alert window forcing you to inject capital to your bank. It will do the following two things instead:

a) It will stop issuing new loans and display an icon on the Overall page and Loans page of the bank informing you about it, as shown in the below screenshots.

![]()

![]()

b) It will notify you via the Event Tracker, which shows a flashing alert icon at the bottom-left of the screen. (the same type of alert that you get when a product supply link is broken.)

![]()

Click on the Event Tracker icon to see the alert message.

3) No Notification

When the bank capital ratio is too low, the game will stop issuing loans without notifying you. This mode is not recommended, as it is highly risky to have the bank capital ratio depleting without your awareness.

Strategy Guides:

1) Mastering Bank Management: A Comprehensive Guide by Stylesjl

2) Youtuber Lightproton’s Bank Setup and Management Video Guide

Return to Banking and Finance DLC Main Page