Bank Headquarters

To establish a bank, open the Build menu, select [Bank and Finance DLC]. Then choose the Bank Headquarters building and place it on the city map.

Note that the capital required for setting up bank headquarters entails two parts. Half of the capital will be used for setting up the headquarters, the other half will be injected into the newly established bank as its operating capital.

You could access various information pages from bank HQ that provide you with insights about the bank’s operations. The details are described below.

Overview

This page provides an overview of the bank’s operation. You may change the deposit interest rate and the staff training budget here.

On this page, you could manage your bank by making changes to the following:

Bank deposit interest rate – You can use the [+][-] button to change the interest rate for 1 year time deposit. Once you have made a change, the system will automatically make corresponding changes to interest rates of other deposit terms (6 months, 2 year, 3 years and 5 years as well as saving accounts).

Staff training budget – It displays the average staff training budget of all your branches. You can use the slider to change it and the change will automatically be applied globally to all your branches.

This page also displays information critical to the operations of your bank. For detailed descriptions, please see below.

Staff Skill Level

The average staff skill level of all the bank’s branches. It affects the overall service quality of the bank. If the City Economics Simulation DLC is enabled, the skill level is also affected by the education level of people in the city.

Customer Waiting Time

The average customer waiting time of all the bank’s branches. It affects the overall service quality of the bank. To serve your customers better, you should open new branches whenever the customer waiting time is alarmingly long.

Quality of Service

The average service quality of all the bank’s branches. It is determined by the Staff Skill Level and the Customer Waiting Time. When the Customer Waiting Time is higher than 30, it starts to negatively affect the Quality of Service.

Bank Brand Rating

The brand rating of the bank in each city. To increase it, go to individual bank branches located in different cities and access the [Marketing] page there to set up advertising in respective cities.

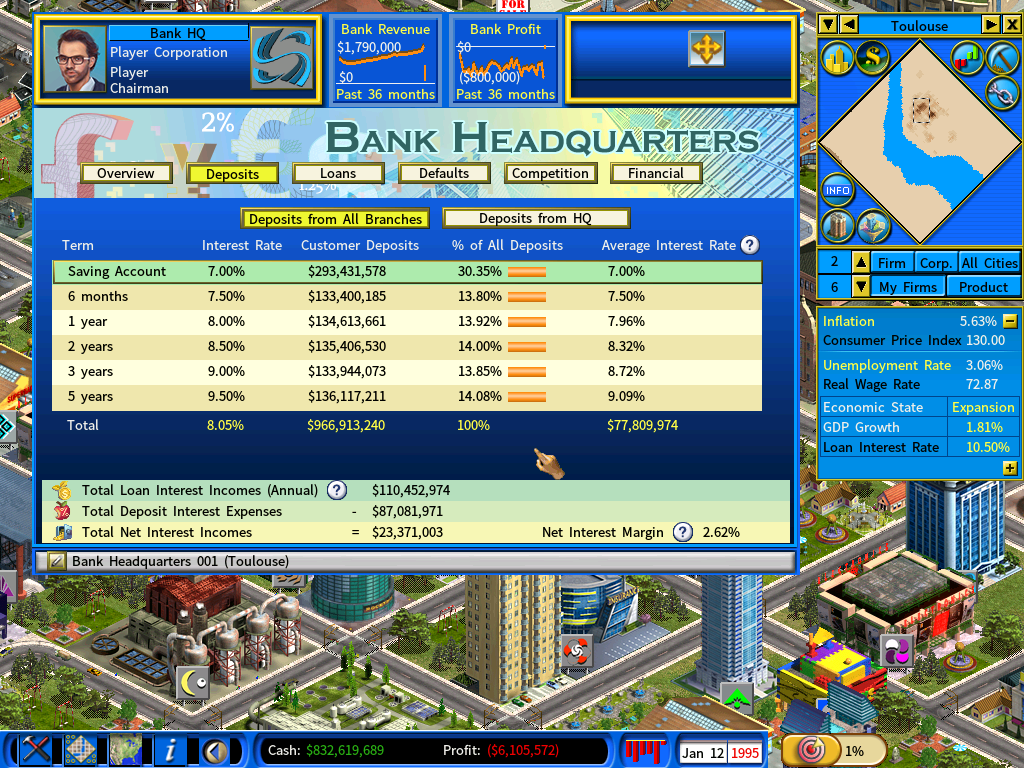

Deposits

This page allows you to view [Deposits from all Branches] and [Deposits from HQ Deposits].

When [Deposits from all Branches] is selected, it shows the details of deposits that customers placed in the bank via branch offices. Deposits in saving accounts receive the lowest interest payouts from the bank.

Time deposits offer higher interest rates and the money must stay in the account for a set period of time, ranging 6 months to 5 years.

As a general rule, time deposits of longer terms pay out higher interest than those of shorter terms. The system automatically sets the interest rates of all deposit types based on the 1 year time deposit interest rate that you set on the Overview page.

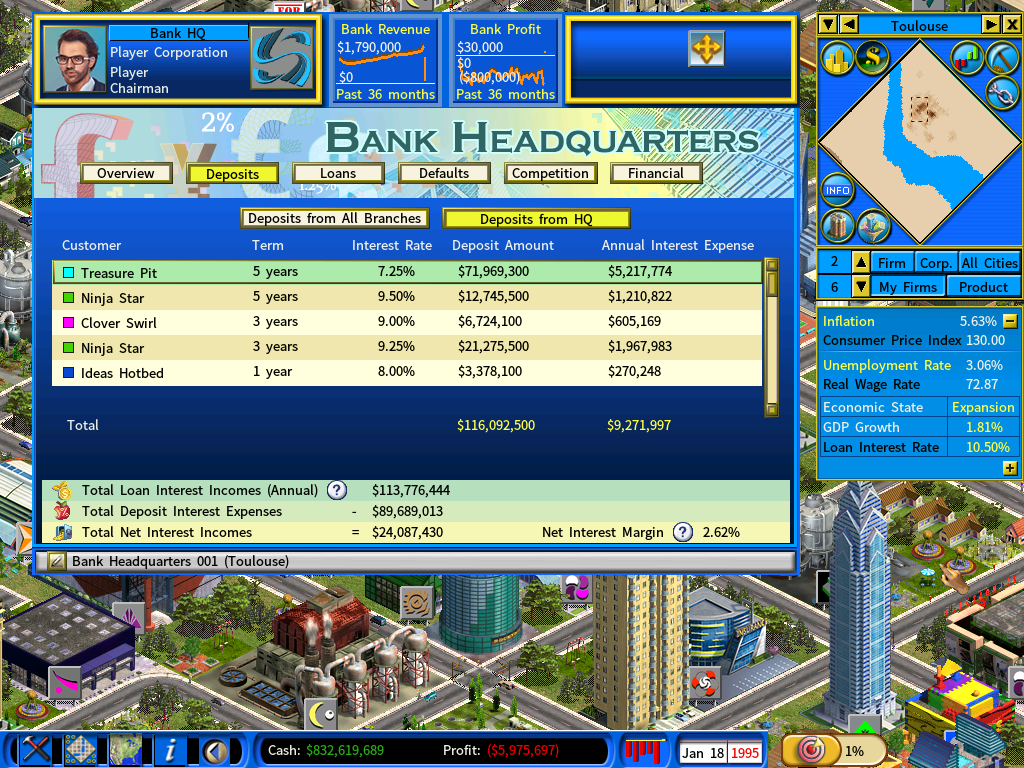

When [Deposits from HQ] is selected, it shows a list of deposits made by corporations and in-game persons via the bank headquarters.

Loans

From a bank’s perspective, loans are assets for a bank since banks earn interest incomes from lending. Deposits, on the other hand, are liabilities because banks must pay interests on those deposits. The difference between the two is a bank’s net interest incomes.

While it seems straightward that a bank’s net interest incomes can be increased by simply increasing the interest incomes from loans, in truth, loans with higher interests also carry higher default risks. During an economic downturn, high-interest loans given to borrowers with poor credit ratings are highly vulnerable to defaults.

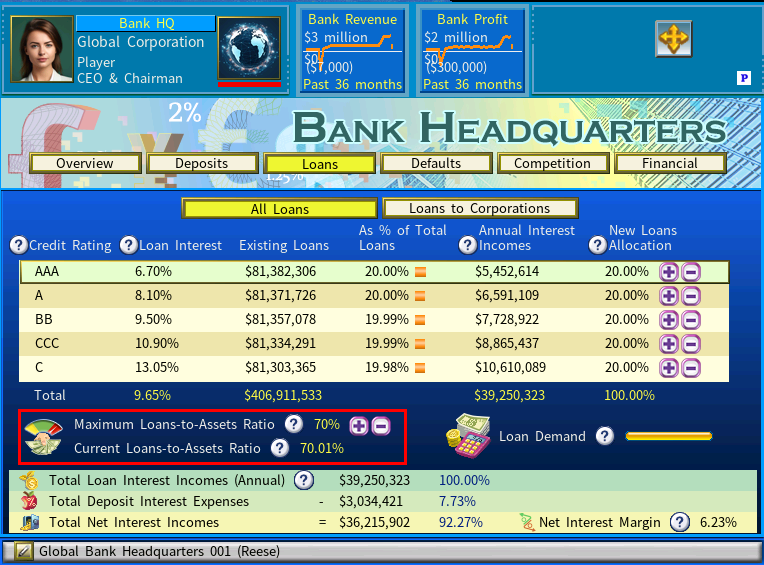

The [All Loans] page allows you to set the allocation of loans to borrowers of different credit ratings by changing the percentages on the New Loans Allocation column using the [+] and [-] buttons, as shown below.

At the initial settings, At the initial setting, a bank lends money evenly to borrowers of different credit ratings (20% each).

If you are a conservative banker, you may choose to maintain a conservative loan portfolio with reduced exposure to high risk loans. On the other hand, if you are willing to take risk, you may increase allocations to high risk loans which pay out higher interest incomes.

Strategy Tips:

High-interest loans are a double-edged sword and a bank’s profitability is highly dependent on the state of the economy. In a booming economy, even if a bank has taken excessive risk by lending aggressively to high risk borrowers, it may still find itself enjoying high interest incomes with relatively few loan defaults. Conversely, a recession can hit banks hard. The same strategy of aggressive lending that makes a bank so profitable at good times will inevitably lead to significant write-offs in loan defaults during a recession.

Loans to Corporations

You can view the details of individual loans given to corporations by selecting [Loans to Corporations].

Loan-to-Deposit Ratio

At the lower part of the screen, you will see the following information:

Current Loan-to-Deposit Ratio

The bank’s current loan-to-deposit ratio is calculated by dividing the bank’s total amount of loans by the total amount of deposits.

The proper loan-to-deposit ratio is a delicate balance for banks. If a bank lends too much of its deposits, it runs the risk of stumbling into a liquidity crisis, which occurs the bank does not have sufficient funds to meet deposit withdrawal requests.

However, if a bank lends too few of its deposits, it will lower the bank’s profit for the deposits being idle earning no interest incomes.

Maximum Loan-to-Deposit Ratio

You can set the maximum amount of loans that the bank can lend out using the [+][-] buttons. When the current loan-to-deposit ratio exceeds the maximum loan-to-deposit ratio, the bank will stop giving out new loans.

Typically, the ideal loan-to-deposit ratio is between 80% and 90%.

The absolute maximum loan-to-deposit ratio can be set in the New Game Setting menu, under the [Bank] settings page.

Loan Defaults

While loan defaults are inevitable, you can minimize them by reducing your bank’s exposure to high risk loans. On this screen, you can select [All Defaults] to view the default rates of loans given to borrowers of different credit ratings. Unsurprisingly, borrowers with poor credit ratings could have default rates many times higher than those with good credit ratings.

To see to the details of individual cases of defaults by corporations in the game, you can select [Defaults by Corporations].

At the bottom of the screen, you can see the impact of loan defaults on the bank’s bottom line profit.

It is apparent that the key to a successful bank is setting the right deposit interest rate to attract deposits, and making sensible loan allocations with balanced risk and return considerations, for the goal of maximizing net loan interest incomes and at the same time minimizing loan defaults.

Competition

This page shows the competing banks. You can view the deposit interest rates they offer and their market shares, and see if it warrants raising your bank’s deposit interest rate to stay competitive.

Financial Statements

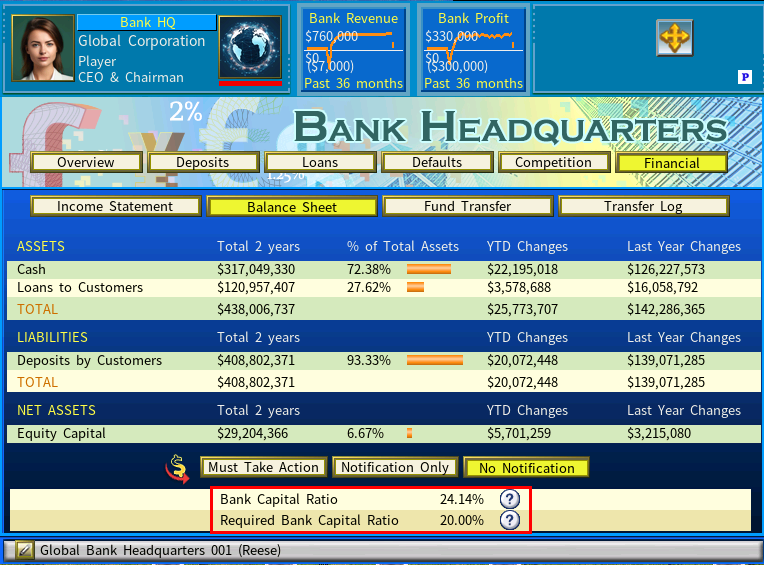

On the [Financial] page, you can view the bank’s income statement and its balance sheet.

The income statement shows the combined financials for the bank headquarters and all its bank branches.

The bank’s balance sheet, owing to its importance in banking, is explained in detail in the following article separately:

Understanding Bank Capital RequirementsTransferring funds between a bank and its parent corporation

On the [Financial] page, select [Fund Transfer] to access the interface shown below.

You may change the transfer mode – whether it is to transfer funds from the bank to its parent corporation, or vice versa, by clicking on the Arrow icon, which is displayed prominently in the center of the screen.

The maximum amount of cash you are permitted to transfer from the bank to your corporation is subject to the following restrictions:

1) On its balance sheet, the bank’s Bank Capital Ratio must not fall below the Required Bank Capital Ratio.

2) Additionally, the bank’s Loans-to-Assets Ratio must not exceed the Maximum Loans-to-Assets Ratio indicated in the “Loans” section.

You may view the transfer history of the bank by selecting [Transfer Log].

Strategy Guides:

1) Mastering Bank Management: A Comprehensive Guide by Stylesjl

2) Youtuber Lightproton’s Bank Setup and Management Video Guide

Return to Banking and Finance DLC Main Page