Insurance Headquarters

To set up an insurance company, open the Build menu, select [Bank and Finance DLC]. Then choose the Insurance Headquarters building and place it on the city map.

Note that the capital required for setting up an insurance company entails two parts. Half of the capital will be used for setting up the headquarters, the other half will be injected into the newly established insurance company as its operating capital.

You could access various information pages from insurance HQ that provide you with insights about the insurance company’s operations. The details are described below.

Overview

This page provides an overview of the insurance company’s operation.

The first piece of information you see is the total amount of Insurance Premiums that the insurance company has received in the past 365 days, including all insurance types (Life insurance, Home insurance and Car insurance.)

Insurance Premiums are regular periodic payments made by insurance policyholders to the insurance company.

An Insurance Company’s Competitiveness is determined by its 1) Price, 2) Quality of Services, 3) Brand and 4) Locations of insurance front offices (customer traffic index). Below we will explain them in detail.

Premium Price Level

The average premium price level of Life Insurance, Home Insurance and Car Insurance. You can change your insurance company’s price level of each insurance type on the [Insurances] page.

Quality of Service

The Service Quality of the insurance company is determined by its Staff Skill Level and the Customer Waiting Time.

With a decent Training Budget, which you can adjust on this screen, the Staff Skill Level will increase over time. If the City Economics Simulation DLC is enabled, it is also affected by the education level of the citizens.

When the Customer Waiting Time is higher than 30, it starts to negatively affect the Quality of Service. You can reduce it by setting up new Insurance Front Offices to share the workload.

Brand Rating

The brand rating of the insurance company in each city is displayed at the lower part of the screen. To increase it, go to individual insurance front offices located in different cities and access the [Marketing] page there to set up advertising in respective cities.

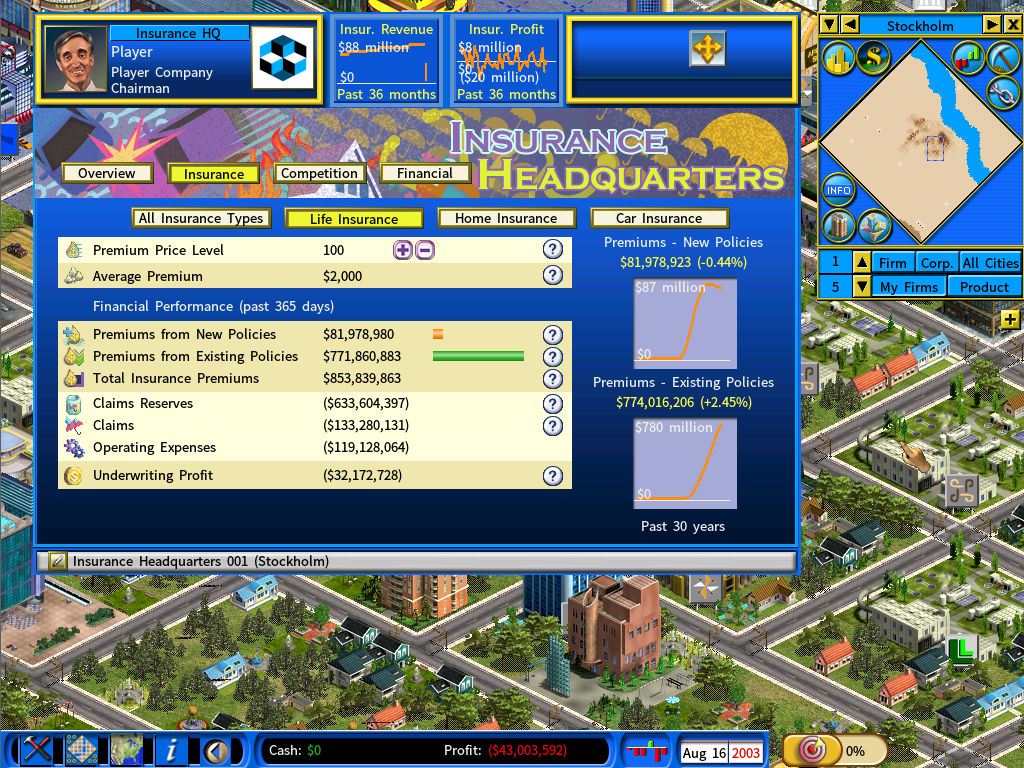

Insurance

In this section, you can view the business details of Life insurance, Home insurance and Car insurance.

Life Insurance

This screen shows the total amounts of Premiums from New Policies and Premiums from Existing Policies.

Premiums from New Policies are insurance premiums earned from new insurance contracts in a given financial year. Life insurance policies, which are assumed to last an average of 30 years in this game, generate premium incomes for the insurance company on a yearly basis until the policies mature.

Therefore, the amount of premiums from new policies is an important indicator of the strength of the insurance company. When an insurance company is able to bring in good numbers of new policies year after year, it expands the size of its existing policies, providing a reliable and growing stream of premium incomes in the many years to come.

Home Insurance

The market size of home insurance is determined by the population of the city.

The game assumes that 1) 80% of the households buy home insurance, and 2) each household has an average of 3 people.

The formula:

Home insurance market size = population / <number of people in a household> X <percent of the households in a city that buy home insurance>

Car Insurance

The market size of car insurance is determined by the car ownership rate in the city.

The car ownership rate is directly proportional to the city’s real wage rate for the fact that people with higher incomes can better afford to buy cars.

The game assumes that there are 40 cars per 100 people if the real wage rate is 100, then scales it down based on the actual real wage rate .

The formula:

The market size of car insurance = population X 40 / 100 X <real wage rate> / 100;

Competition

This page shows the competition in the insurance industry.

As mentioned above, an Insurance Company’s Competitiveness is determined by its 1) Price, 2) Quality of Services, 3) Brand and 4) Locations of insurance front offices (customer traffic index). The page shows the first 3 factors of all the competing insurance companies, giving you a good grasp of the status of the competition.

Also See:

Make Investments Using Other People’s Money

Return to Banking and Finance DLC Main Page