Make Investments Using Other People’s Money

One of the biggest advantages of operating an insurance company is that you can use the money that your insurance company is holding for policyholders to cover their claims in the future to invest into bonds and stocks, generating sizable investment income for your insurance company.

An insurance company generates profits in the following ways:

Underwriting Profit – an insurance company earns premium incomes by underwriting insurance policies. After claims and operating expenses have been deducted, it produces underwriting profit.

Investment Profit – an insurance company earns income from financial instruments including bonds and stocks. See the below section for more details.

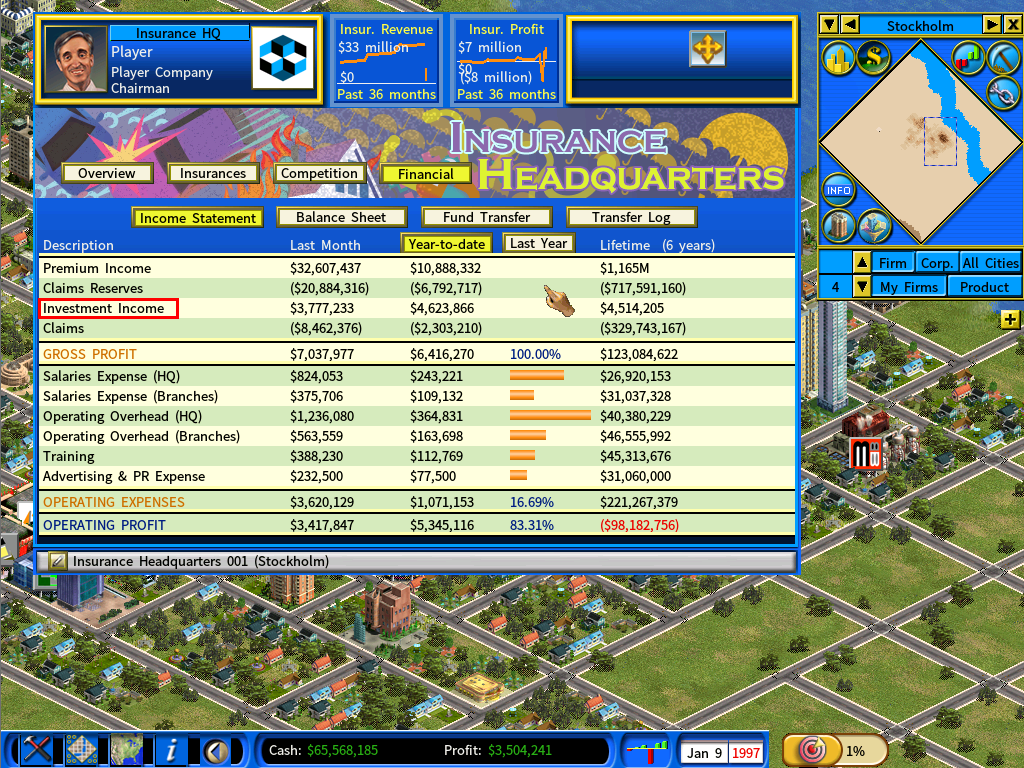

The above screenshot shows an insurance company that is losing money in its insurance business (negative Underwriting Profit) due to intensive competition, but is making a huge profit from investments.

About “Claim Reserves” in the Balance Sheet

Claim reserves are funds set aside for future claims. They are drawn from part of the premiums paid by life insurance policyholders.

The outstanding claim reserves are recorded as liabilities in the company’s balance sheet, as the insurance company is obliged to pay out claims over the course of life insurance contracts.

Using Claim Reserves to Make Investments

Before paying out the claims, an insurance company can freely use the claim reserves to invest into bonds and stocks, generating investment income by way of bond interests, stock dividends and gains in market values of held stocks and bonds.

How to Invest into Stocks

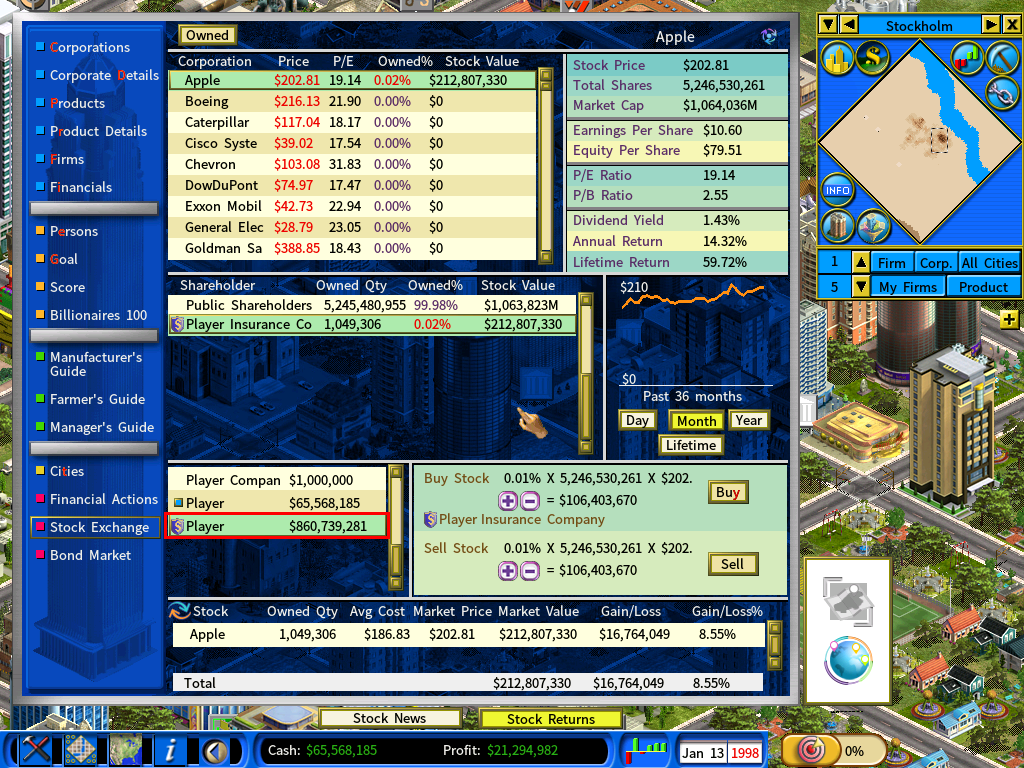

To buy stocks using cash from your insurance company, select your insurance company from the stock market screen, as highlighted in red in the below screenshot. (Your insurance company is marked with an icon in front of its company name.)

How to Invest into Bonds

Similarly, to bonds stocks using cash from your insurance company, select your insurance company from the bond market screen, as shown below.

Seeing the Investments in the Financial Statements

You can see the investments in the Balance Sheet of the insurance company under the accounts Stock Assets and Bond Assets.

And you can see the combined Investment Income, including bond interests, stock dividends and gains in market values of held stocks and bonds, in the Income Statement.

Also See:

Insurance Headquarters