Venture Capitalists

Venture Capitalists with billions of net worth will join the game when this feature is enabled.

Venture Capitalists only invest in companies in pre-IPO rounds. They are committed to long-term investments and do not actively trade stocks.

When using this feature in conjunction with the Realistic Money Supply option, venture capital will be an indispensable source of funding when the public investors lack cash to invest.

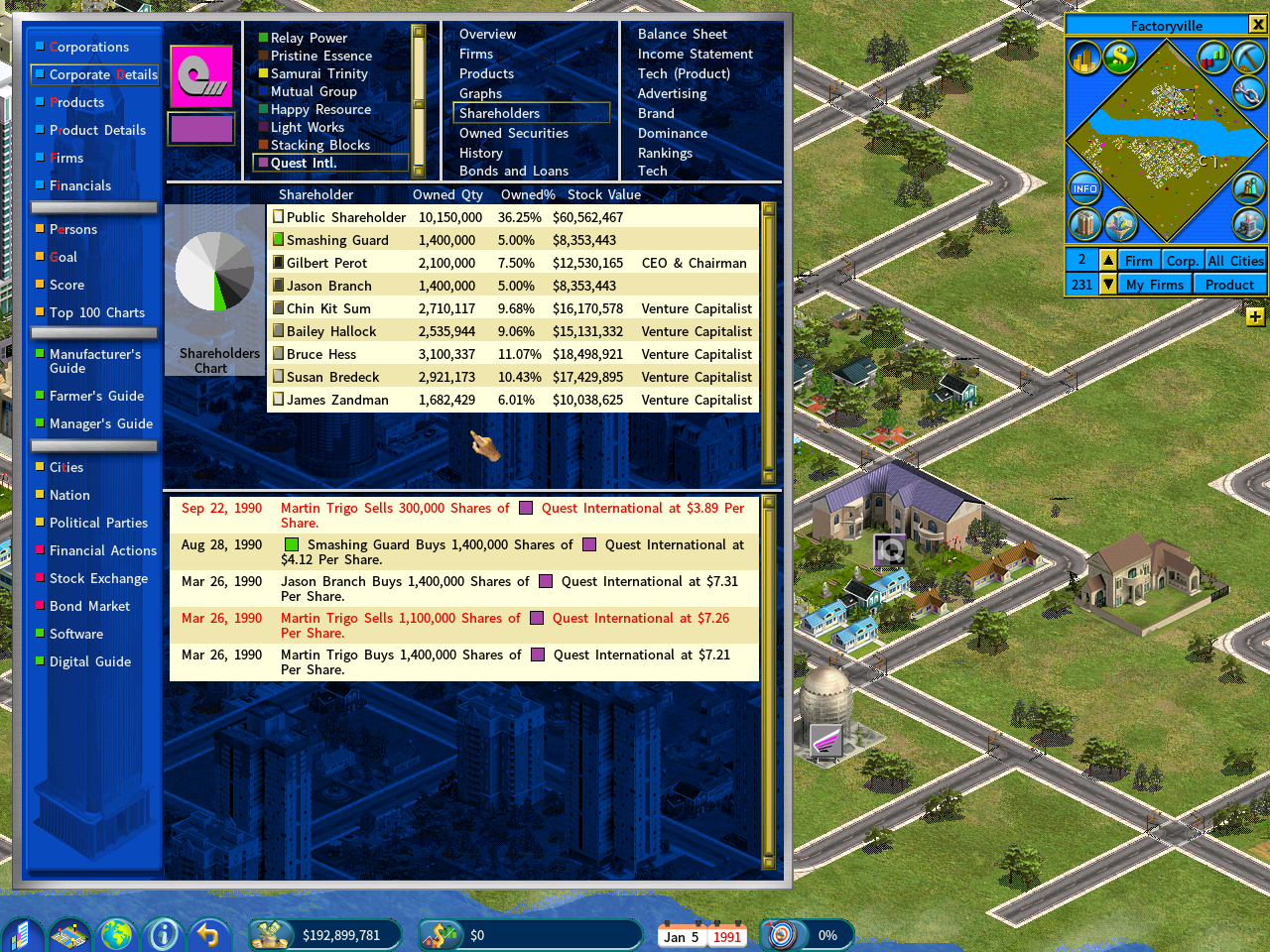

The following screenshot shows a venture capitalist’s investment portfolio.

Venture capitalists can be found on the Person report. They are typically at the bottom of the person list. (Hover the mouse over the person list and press the [End] key to go to the bottom of the list instantly.)

This screenshot shows that a company that is heavily backed by venture capitalists.

Venture Capitalists Settings

You can customize the financial prowess and influence of venture capitalists in the game by adjusting the settings described below.

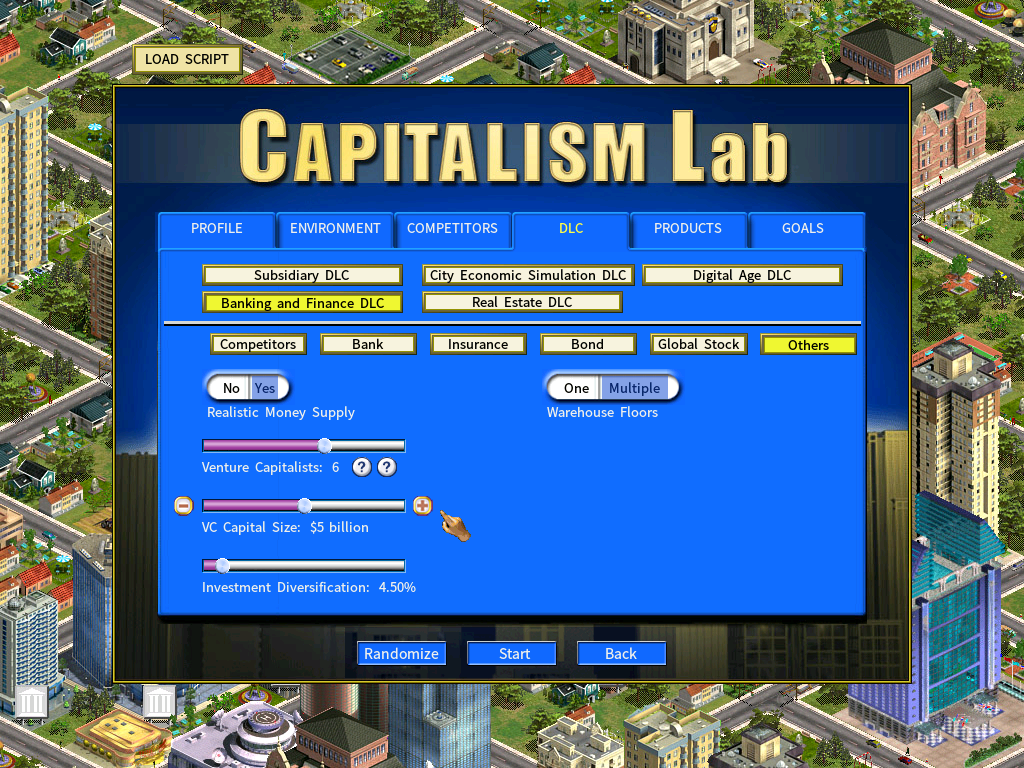

Firstly, access the [Others] page on the new game settings menu of the Banking and Finance DLC.

You will see the following settings:

1) The Number of Venture Capitalists in the Game

You can set it to a value ranging from 0 to 10. When this is set to zero, the Venture Capitalists feature will be disabled.

For the sake of gameplay balance, when Realistic Money Supply is enabled, the game will automatically assign a minimum of 5 Venture Capitalists to the game.

The Realistic Money Supply mode limits the availability of funding from public investors. Under such a setting, it is imperative that companies can have access to venture capital, otherwise they will lack proper funding to expand, undermining the gameplay.

However, if Survival Mode is enabled, then Venture Capitalists can be set to any number, as companies are supposed to be under a constant struggle to survive in this mode.

2) VC Capital Size

This sets the average capital size of a venture capitalist.

3) Investment Diversification

This determines how diversified a venture capitalist’s investment portfolio will be. Typically a single investment, as a percentage of the VC’s total net worth, will not exceed the percent specified here.

Together, the VC Capital Size and Investment Diversification settings affect the number of companies that each VC will be able to invest and the average size of each investment.

Here are a couple examples to illustrate how they work in the game:

Example 1) For a Venture Capitalist (VC) with $3 billion capital who will not invest more than 5% of his total capital into a single company, each investment will not exceed $3 billion x 5% = $150M.

The VC will be able to invest into 20 companies (100% / 5% = 20) before the capital is fully invested.

Example 2) For a VC with $5 billion capital who will not invest more than 4% of her total capital into a single company, each investment will not exceed $5 billion x 4% = $200M.

The VC will be able to invest into 25 companies (100% / 4% = 25) before the capital is fully invested.

Return to Banking and Finance DLC Main Page