Issuing and Buying Corporate Bonds and Municipal Bonds

One of the most anticipated new features for the Banking DLC is the ability to issue corporate bonds.

Compared to taking loans from bank, issuing corporate bonds offer you the advantage of lower interest expenses and is generally a preferred way of raising funds for your business.

To issue a new bond, access the “Financial Actions” page from the Information Center (hot key: F11). Then select “Issue New Bonds” at the top-right of the interface.

Now set the Issue Quantity and the Term Length of the bond you intend to issue, then click the “Issue Now” button to issue the new bond.

The Term Length can be 5 years, 10 years, 15 years or 20 years.

The Bond Credit Rating can range from the highest credit rating of “AAA” to the lowest credit rating of “D”.

Investment-grade credit ratings:

AAA – Prime investment-grade

AA – High investment-grade

A – Upper medium investment-grade

BBB – Lower medium investment-grade

Junk bond credit ratings:

BB – Non-investment grade (Junk bond )

B – Highly speculative junk bond

CCC – Extremely speculative junk bond

CC – Junk bond with substantial risks

C – Junk bond high likelihood of default

D – Junk bond that is default imminent with little prospect for recovery

The Coupon Rate is the rate of interest payments that your company makes to the bond holders annually. It is affected by the bond’s Term Length and its Credit Rating. A longer term and a lower credit rating increases the coupon rate and your interest payment burden.

In the above example, the company has successfully raised $10 million and $20 million respectively by issuing 5-year bonds at a coupon rate of 5.5% and 10-year bonds at a coupon rate of 6.5%.

The Bond Market

As an investor, you may buy and sell bonds issued by other companies on the secondary market. To access it, either select “Bond Market” from the Information Center or press the hot key Ctrl-B.

If the City Economic Simulation DLC is enabled, you will be able to buy municipal bonds issued by city governments as well. There are buttons at the top of the interface allowing you to limit the bond list to show only corporate bonds, or municipal bonds or both.

When buying or selling a bond, the key pieces of information to pay attention to are:

Credit Rating – the bond’s current credit rating.

Price (market price of the bond) – This is the price investors willing to pay for buying the bond. It is affected by the central bank’s interest rate and any changes that may have happened to the bond’s credit rating. For example, an improvement to the bond issuer’s financial conditions may lift the bond credit rating and thus positively affect the market price of the bond. Conversely, if the company’s financial situation worsens, its bond price will decline.

When the central bank hikes the interest rate, it will have a widespread effect to the bond market and virtually all bonds will suffer from price delinces as investors demand higher interest payments from bonds in general.

Yield (yield to maturity) – For an investor buying a bond from the bond market, the market price may be different from the initial bond price. The price difference affects the effective return that the investor will receive. For example, when an investor buy a bond at $90, which is $10 lower than the initial bond price of $100, the total return will be higher than the coupon rate, thanks to the lower purchase cost. The effective return rate is called yield to maturity.

As a bond investor, you may choose to hold a bond until its maturity and receive regular incomes from its interest payments, or trade bonds on the bond market for quicker profits with the buy low, sell high technique.

Viewing the Issued Bonds of a Corporation

You may view the list of issued bonds of a selected corporation on the “Bonds and Loans” page from the Corporation Details screen.

A Company Buying Back Its Own Bonds

A company may opt to buy back its own bonds from the secondary market, reducing its bond interest payments. This option is particularly appealing when the bond price is significantly below the issue price and the company has ample liquidity.

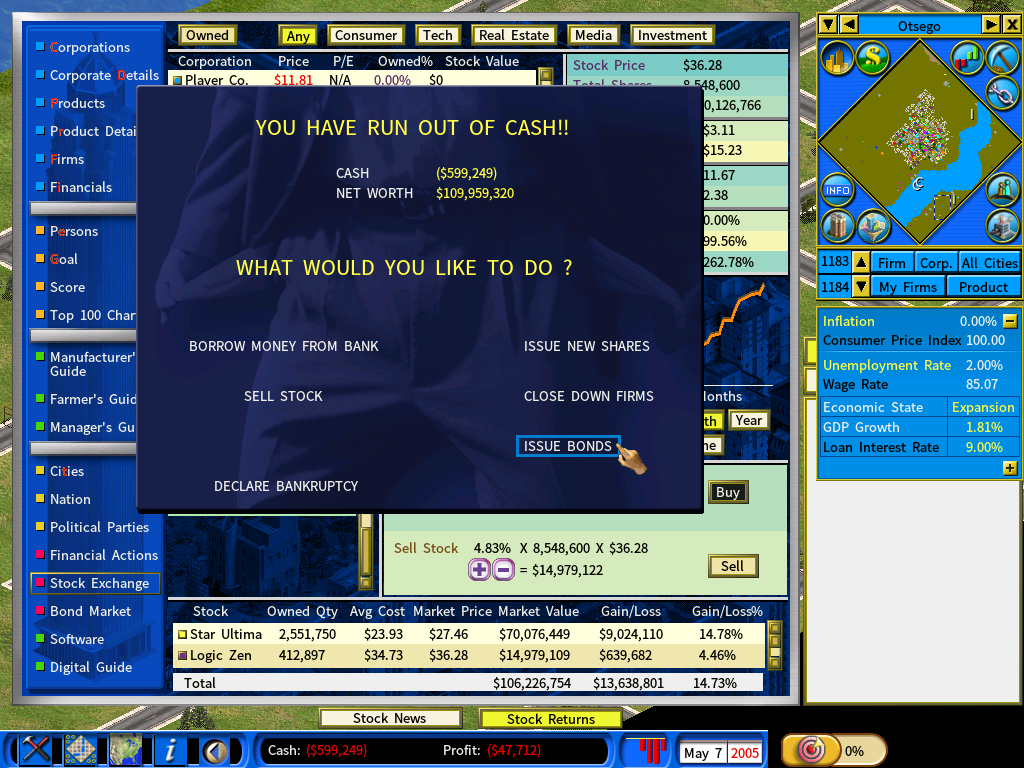

The “Out of Cash” Screen

A new option to issue bonds to raise funds is now available on the “Out of Cash” screen.

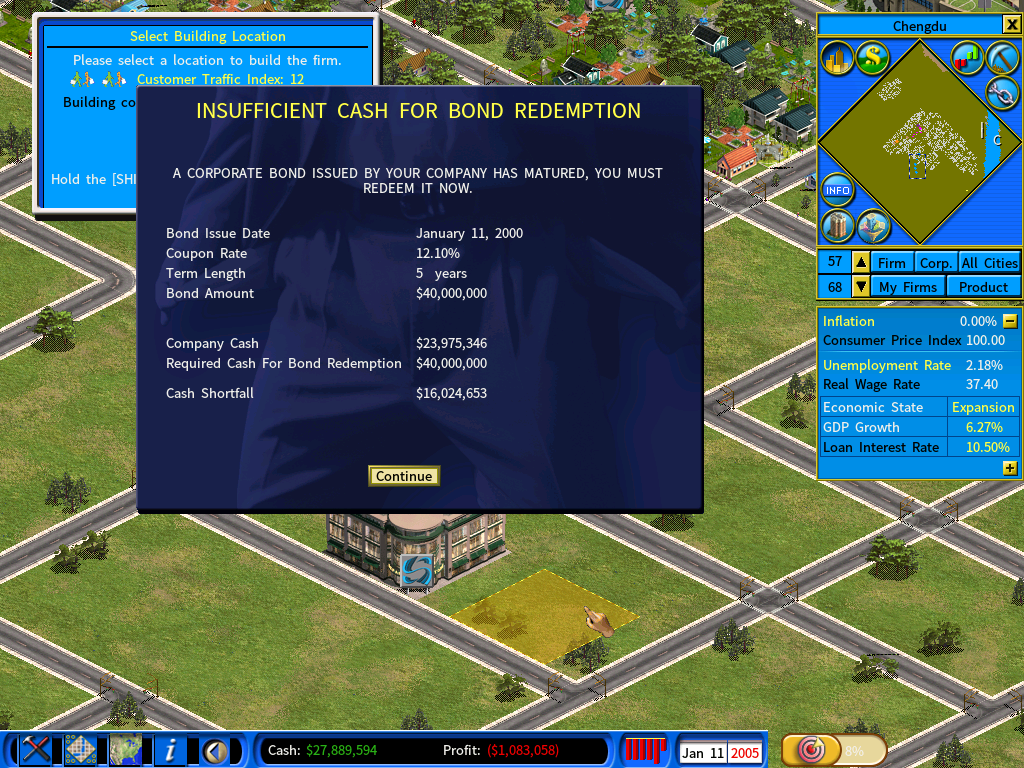

Bond Redemption

At the maturity of a bond, the bond issuer is obliged to redeem the bonds. If the bond issuer does not have sufficient cash for the bond redemption, it will have to raise funds by other means such as getting new bank loans or selling its assets.

Bond Default

A bond default happens when the company behinds the bond has gone bankrupt. Investors of the bond may lose all the values.