New Game Settings of Banking and Finance DLC

The Banking and Finance DLC comes with a large array of game settings. By experimenting with different setting values, you could customize each sandbox game to deliver a refreshing challenge.

For instance, if you want, you may use the Personal Savings Rate Modifier to dramatically increase the amount of savings people deposit in banks, thus boosting the profitability of banks in general. Ultimately it’s your call to decide whether banks will be hugely profitable financial powerhouses or just play a modest and complementary role in supporting your business expansion.

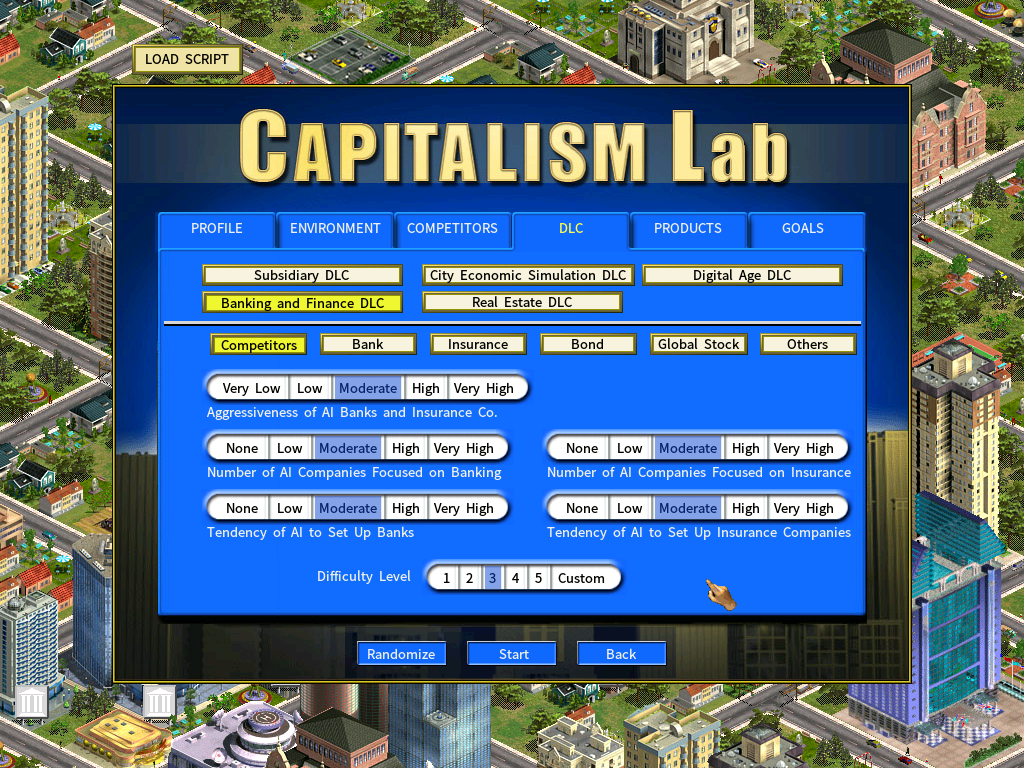

The game settings are grouped under multiple pages for easy access. Below we will introduce them one by one starting with the [Competitors] page.

Competitors

Difficulty Level for Banking and Finance DLC

Use this to set the overall difficulty level for operating banks and insurance companies.

Aggressiveness of AI banks and insurance companies

A higher value means that AI banks will aggressively lure customers from competitors by offering higher deposit interest rates, and AI insurance companies will offer more competitively priced insurance products.

Number of AI Companies Focused on Banking

This determines the number of AI companies focused on banking in the beginning of the game.

Number of AI Companies Focused on Insurance

This determines the number of AI companies focused on insurance business in the beginning of the game.

Tendency of AI to set up banks

Tendency of AI companies with a diversification business strategy, which may expand into any types of industry, to set up banks.

Tendency of AI to set up insurance companies

Tendency of AI companies with a diversification business strategy, which may expand into any types of industry, to set up insurance companies.

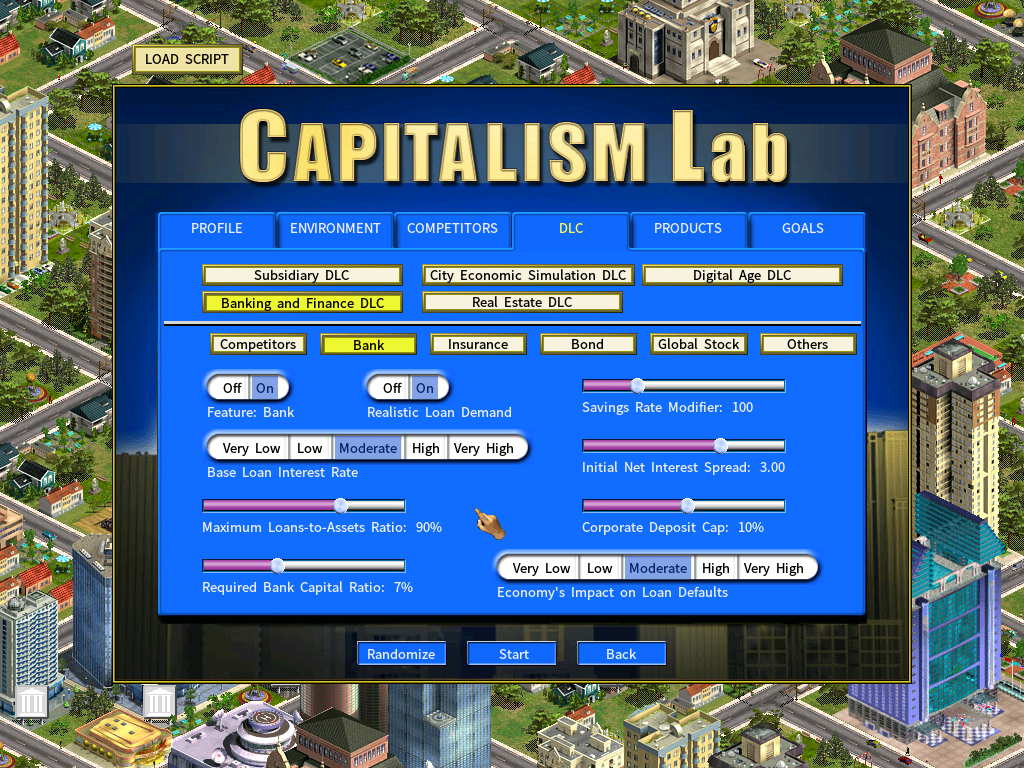

Bank

Feature: Bank

This setting determines whether banks can be set up in the game or not.

Realistic Loan Demand

When it is enabled, the demand for bank loans is limited instead of being infinite.

The demand for bank loans is correlated to the total GDP of all cities. You can see the current Loan Demand indicator on the Loans page of your Bank HQ.

When there is no new demand for bank loans, you will find cash in your bank sitting idle, generating no interest incomes. At the same time, your bank still has to pay interests to existing client deposits, thus undermining its profitability.

To lessen your burden, when Realistic Loan Demand is enabled, you will have access to a new setting called ““Threshold for Stopping Accepting Corporate Deposits” on the “Deposits from HQ” page of the Bank HQ interface.

When it is enabled, the bank stops accepting new deposits from corporate clients when the bank’s cash as a percentage of its total assets exceeds the specified threshold.

Savings Rate Modifier

This slider modifies the personal savings rate. A higher personal savings rate means that people will save and deposit more money into banks, thus boosting the profitability of banks in general.

Base Loan Interest Rate

This modifies the base interest rate which affects bonds and bank loans. A higher interest rate increases borrowing costs, posing greater challenges for companies that take on debt to expand.

Initial Net Interest Spread

Net interest spread refers to the difference in the rate at which a bank takes deposits from customers, and the rate at which it offers loans. A larger net interest spread means a greater profit margin for a bank.

Maximum Loan-to-Asset Ratio

This determines the Absolute Maximum amount of loans that a bank can lend out (including your bank and AI banks). A conservative bank may set a lower Maximum Loans-to-Assets ratio on the bank HQ interface, provided that it does not exceed the one defined here.

Corporate Deposit Cap, as a percentage of the total bank deposits.

The bank regulation stipulates that deposits should be not concentrated on a small number of large depositors. There is a cap that limits the maximum amount of deposit each depositor can make.

Required Bank Capital Ratio

The central bank requires banks to set aside enough capital to cover unexpected losses and keep themselves solvent in a crisis. A capital ratio is the ratio of a bank’s equity capital to its total assets.

Economy’s Impact on Loan Defaults

It determines the economy’s impact on the loan default rate. When this is set to a higher value, loan defaults will soar at a higher rate during an economic downturn, leading to a potential liquidity crisis.

Therefore, this setting has a greater impact on the profitability of banks with large amounts of high-risk, high-interest loans.

If you find the risk/return trade-off of banks in your game is not in the range you prefer, you could adjust it using this setting.

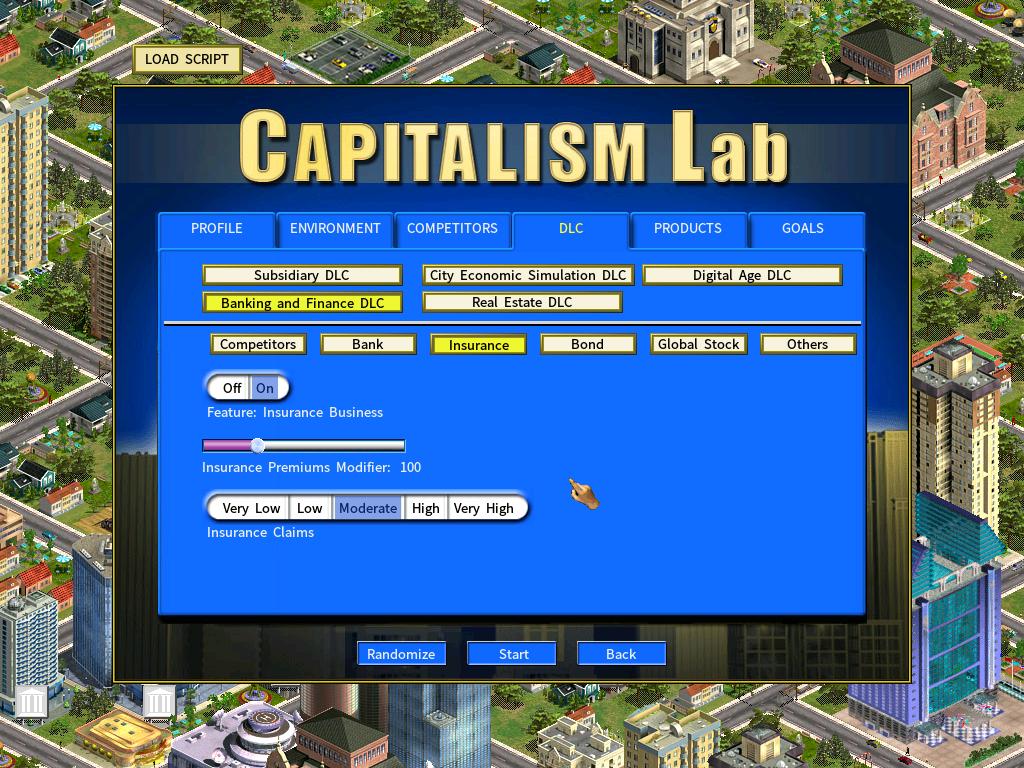

Insurance

Feature: Insurance

This setting determines whether insurance companies can be set up in the game or not.

Insurance Premiums Modifier

Setting this to a value higher than 100 will increase revenues of all insurance companies.

Insurance Claims

You may customize the average amounts of insurance claims that insurance companies have to pay. A lower insurance claims ratio means a higher profit margin for insurance companies.

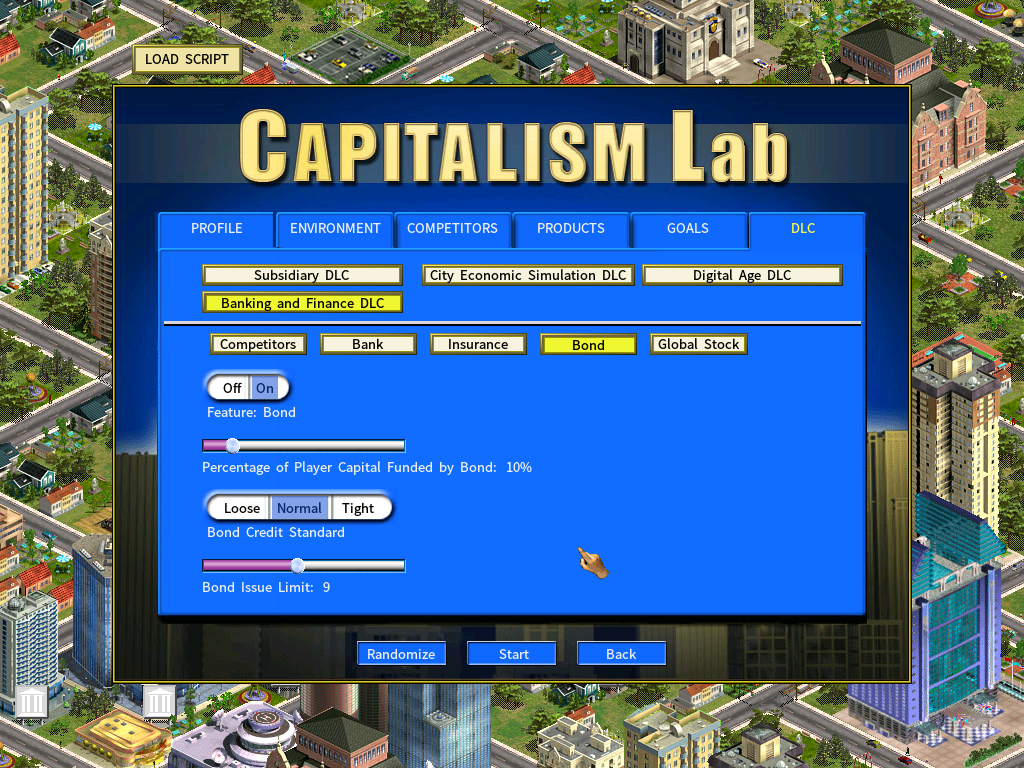

Bond

Feature: Bond

When this feature is enabled, corporations will able to able to issue bonds to raise capital, and the bond market will be accessible.

Percentage of Player Capital Funded by Bond

If you are an experienced player looking for greater challenge, you may set a percentage of your corporation’s initial capital to be funded by a bond issue, requiring you to pay bond interests and repay the bond principal upon its maturity.

Bond Credit Standard

You can choose from Loose, Normal and Tight for this setting. When using a looser credit assessment standard, all corporations will receive better credit ratings and benefit from lower bond interest expenses.

Bond Issue Limit

The maximum amounts of bonds that a corporation can issue is limited to a multiple of its capitalization, which is set here. A higher value will allow a corporation to issue larger amounts of bonds.

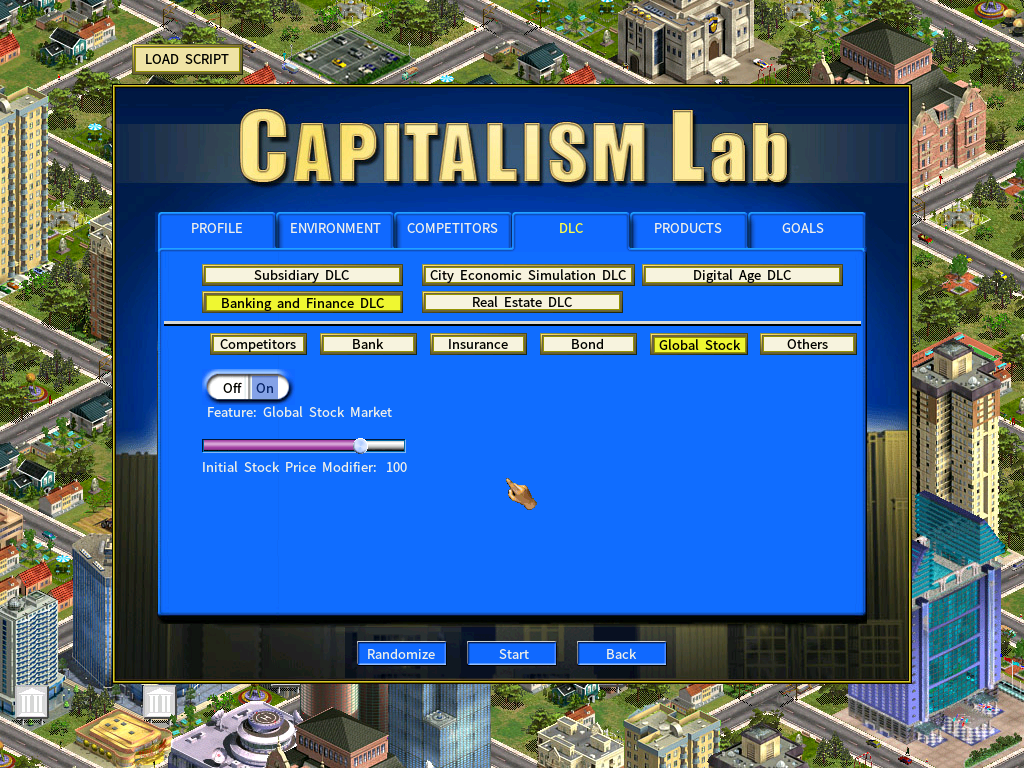

Global Stock

Feature: Global Stock Market

This setting determines whether the global stock market is enabled in the game or not.

Initial Stock Price Modifier

The initial prices of the global stocks are loaded from a database. You may use this modifier to change the initial prices of all global stocks. A lower Modifier value leads to lower initial stock prices, which promise more gain for the global stock market down the road.

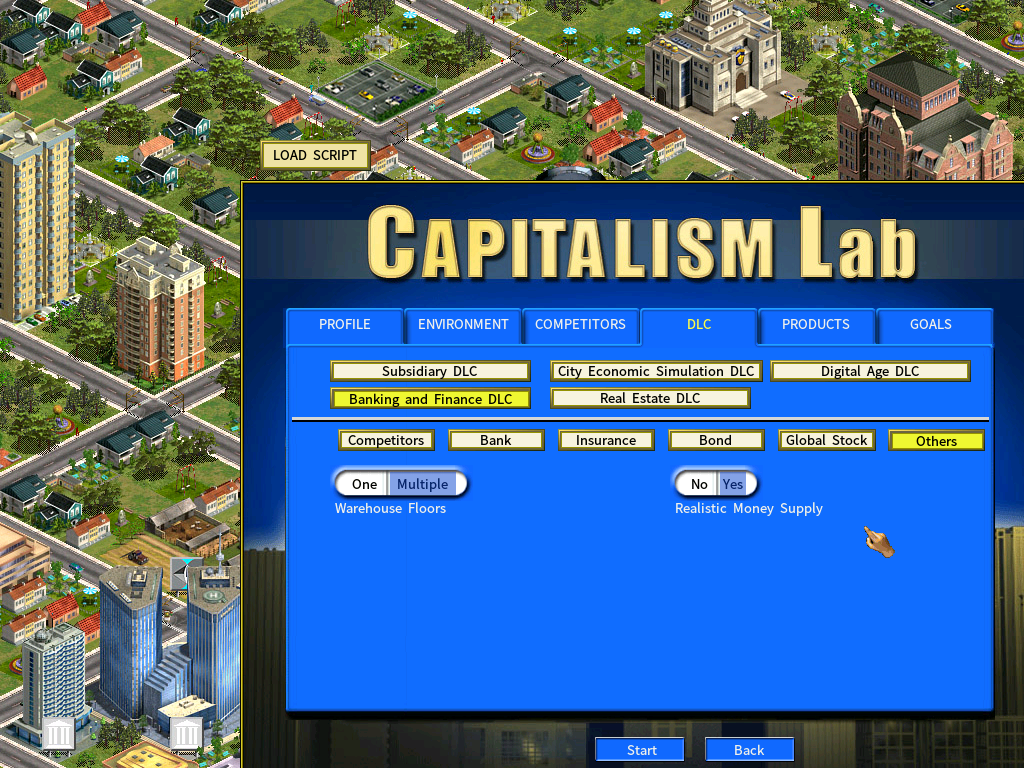

Others

Warehouse Floors

Choose ‘Multiple’ to allow for setting up multiple floors in a warehouse.

Realistic Money Supply

This option is available when both the Survival Mode of City Economic Simulation DLC and Banking and Finance DLC are enabled.

When it is enabled, money supply is more realistically simulated. It will be more difficult for player and AI companies to raise funds from IPO, issuing new shares and bonds.

Return to Banking and Finance DLC Main Page